October 2024

Event Details

Download PDF Invite.

Event Details

DATE

Tuesday, October 22, 2024

TIME

12:50 p.m.–1:50 p.m.

Pizza will be served.

LOCATION

W302

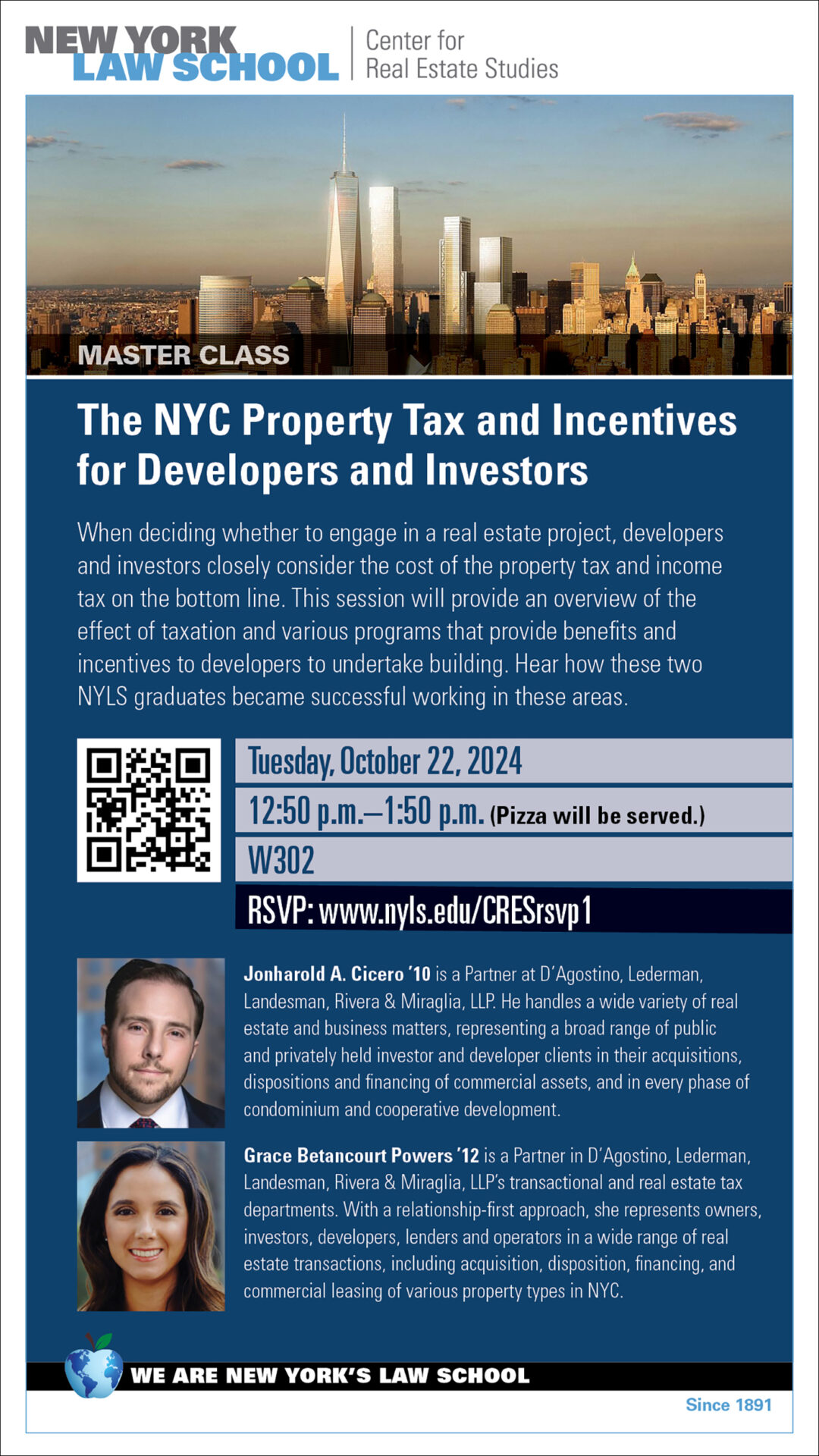

When deciding whether to engage in a real estate project, developers and investors closely consider the cost of the property tax and income tax on the bottom line. This session will provide an overview of the effect of taxation and various programs that provide benefits and incentives to developers to undertake building. Hear how these two NYLS graduates became successful working in these areas.

Jonharold A. Cicero ’10 is a Partner at D’Agostino, Lederman, Landesman, Rivera & Miraglia, LLP. He handles a wide variety of real estate and business matters, representing a broad range of public and privately held investor and developer clients in their acquisitions, dispositions and financing of commercial assets, and in every phase of condominium and cooperative development.

Grace Betancourt Powers ’12 is a Partner in D’Agostino, Lederman, Landesman, Rivera & Miraglia, LLP’s transactional and real estate tax departments. With a relationship-first approach, she represents owners, investors, developers, lenders and operators in a wide range of real estate transactions, including acquisition, disposition, financing, and commercial leasing of various property types in NYC.